This ratio analysis provides an indication of how efficiently management is using both short-term and long-term assets.

Thus all else equal, A high ratio indicates a high degree of efficiency in fixed asset utilization and vice-versa. Also, there are factors such as asset valuation, the timing of a firm's asset purchase that affects this ratio. This is due to the fact that this ratio is affected by several circumstances such as the life cycle of a company, life cycle of a product, plant capacity & relative sales. Interpreting the fixed asset turnover ratio is not easy. In general, it is used by analysts to measure operating performance.įormula: - Net Sales / Average Fixed Assets It tells the efficiency, with which the fixed assets are employed. It either may be overstocking or having an issue with sales.įixed Asset Turnover tells how much amount a company needs to invest to generate 1 rupee of sales. A lower inventory turnover ratio is an indicator that a company is not managing its inventory well. Higher the ratio shows better efficiency in clearing inventories.

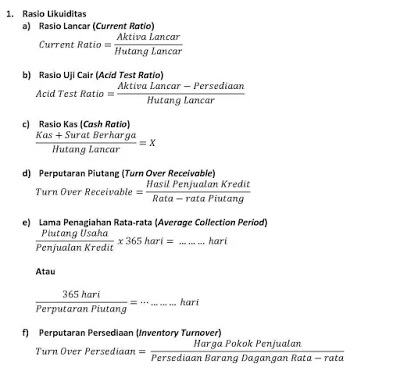

It also expresses the relationship between the cost of goods sold and inventory, and this denotes efficiency in inventory management.įormula: - Cost of goods sold / Average inventory Inventory turnover ratio explains how many times a company has sold and replaced inventory during a given period. However, a very high ratio also tells that the company is facing a liquidity crunch. It may also indicate that the firm is not getting favorable credit terms from its suppliers. It establishes a relationship between net credit annual purchases and average accounts payables.įormula: - Net Credit purchases / Average accounts payablesĪ higher ratio indicates the company’s ability to keep cash on hand for a longer time, and preferable. In other words, the matrix shows the speed at which a company pays its suppliers. The accounts payable turnover ratio is used to see how efficiently a company is at paying its suppliers and short-term debts. Though accounts payable are liabilities, their trend is important as they represent an important source of finance for operating activities, thereby affecting operating efficiency. Account Payable Turnover/ Creditors Turnover: -Īccounts payable is short-term debt that a company owes to its suppliers and creditors. A low ratio indicates the company is having difficulty in collecting its dues or being too liberal in granting creditĢ. If business normally extends credit to customers, the payment of accounts receivable is likely to be the most important source of cash flows and is also called a Debtors Turnover ratio.įormula: - Net Credit Sales / Average accounts receivablesĪ high ratio is always desirable as it shows the company’s efficiency in collecting the dues from clients.

It represents sales for which payment has not been collected yet. Receivable Turnover ratio is used to see the company’s efficiency in collecting its receivables or the money owed by clients. Let’s read on further to understand these ratios to get some clarity These ratios analysis how well a company utilizes its assets and manages its liabilities. Read the guide on Ratio analysisĮfficiency Ratios are a measure of how well an organization is managing its routine affairs. Though this is not a foolproof method, it is a good way to run a fast check on a company's health. An easier way to find out about a company's performance is to look at its financial ratios. However, this can be cumbersome and will not determine the efficiency levels of the business. One can examine the company’s Quarterly and Annual accounts to determine how productively they are managing its assets and liabilities to maximize profits. Stock investing involves a careful analysis of the companies and their financial data to arrive at their true worth.

0 kommentar(er)

0 kommentar(er)